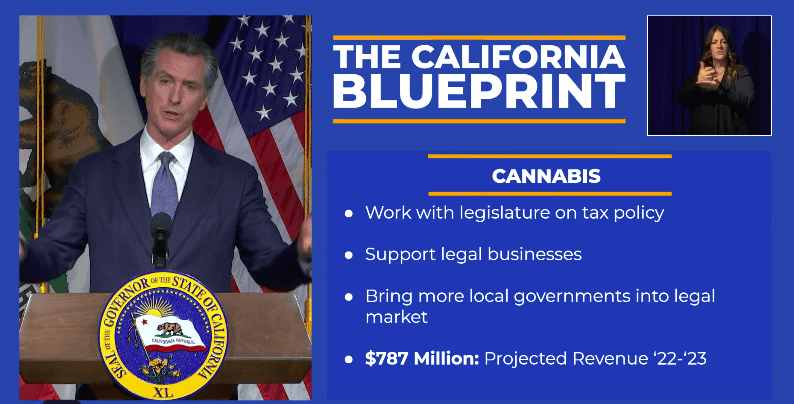

Gov. Newsom has released an ambitious preliminary 2022-2023 budget proposal with billions of dollars for education, behavioral and mental health, housing, climate change response, business development and other projects, along with a call for cannabis tax reform and more local retail outlets in the state.

The budget proposal states:

The Administration intends to further develop a grant program this spring that will aid local governments in, at a minimum, opening up legal retail access to consumers. Further, the Administration supports cannabis tax reform and plans to work with the Legislature to make modifications to California’s cannabis tax policy to help stabilize the market; better support California’s small licensed operators; and strengthen compliance with state law.

Tax Offsets and Local Cooperation Needed

Asked for specifics on these statements at a press conference today announcing the proposal, Newsom responded, “We’ve plugged in budget components on the basis of an estimate in January of $787 million, so any reforms need to consider the impacts to those categories of funding and investments, how that gets offset, and we augment that support. It should consider different components of the industry, and reforms have been offered aplenty, and so I’ll just leave it at that except to say there was intention by having that language in the budget.”

He added, “It is my goal to look at tax policy to stabilize markets; at the same time, it’s also my goal to get these municipalities to wake up to the opportunities to get rid of the illegal market and the illicit market and provide support and a regulatory framework for the legal market….we have a lot of work to do in this space…and this year I’m looking forward to working directly with the legislature on reforms.”

Also mentioned during the press conference was a “Keeping Our Streets Safe” campaign enlisting the CHP and AG to assist mayors with enforcing against organized “smash and grab” thieves, which have been targeting cannabis businesses, and others.

The Governor said in general he anticipates major changes between this proposal and his May revision. The legislature now will develop their own proposed budget this Spring, when there will be several budget policy committee hearings.

Momentum Building Towards Cannabis Tax Reform

The governor’s pronouncement comes on the heels of calls from the industry and others for an urgent overhaul of cannabis taxes in California. In December, California NORML signed onto a letter to Gov. Newsom and CA’s legislative leadership calling for an immediate lifting of the cultivation tax placed on growers, a three-year holiday from the excise tax, and an expansion of retail shops throughout much of the state.

The Sacramento Bee editorialized on 12/22: California is failing on legal cannabis. To honor the will of voters, overhaul is needed, and the LA Times chimed in with an editorial: Californians overwhelmingly supported legalizing marijuana. Why is it still a mess?

Cal NORML is the only advocacy organization fighting for all cannabis consumers (recreational and medical) in California, and you have told us that tax reform is your top priority. Please help us advocate for you in 2022! Join Cal NORML today or Make A Donation.