A “Joint” informational hearing on March 11 before the Assembly and Senate Business and Professions committees on the CA Department of Cannabis Control’s new Condition and Health of the Cannabis Industry Report presented a grim picture of the state of the industry and its future.

Asm. Mike Gipson (D-LA), chair of the Assembly Revenue & Tax committee, and Asm. Sharon Quirk-Silva (D-Buena Park) who chairs the Budget subcommittee that oversees the Department of Cannabis Control (DCC), also participated. Quirk-Silva said the findings in the DCC report are “very concerning.” Active licenses and total retail sales value are both down. “Is California doing enough to support this industry?” she asked, adding that, “Taxes are a substantial share of business costs.” She said she’d hoped report would give clues to improving viability in that cannabis industry. She, and many others at the hearing, spoke about enforcement being critical for eliminating the cannabis market.

Clint Kellum, chief deputy director of the DCC, introduced DCC’s Christina Dempsey, who gave a background on the laws. She noted, “Most states that legalized opened new markets, but in California had a mature illicit market, previously disincentivized to keep records since that could lead to prosecution.” Within the unlicensed cannabis market, products may be sold to kids, or contain harmful ingredients, she noted. The DCC’s enforcement pision UCETF has removed $2.2 billion worth of illicit cannabis, she said, working with two dozen local, state and federal agencies.

The Economic Report

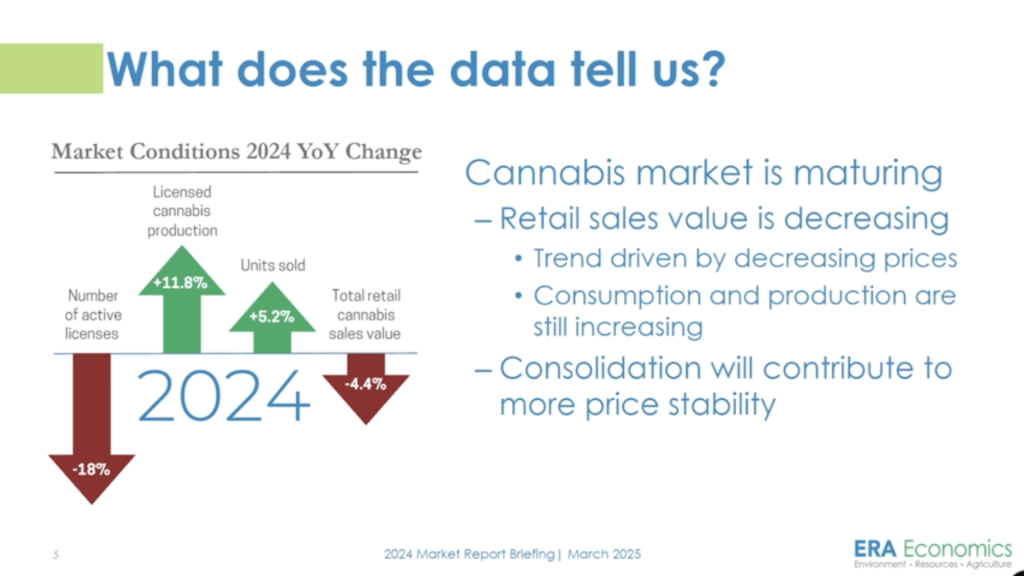

Duncan MacKuen of ERA Economics, who produced the DCC report, spoke about market trends at the wholesale and retail levels, and the challenges of building a market against an active illicit market. The number of cannabis licenses is down, as is overall gross value of industry, even through production is up, because retail and wholesale prices have fallen.

MacKuen said he looked at illicit production, including that produced in California but not being consumed in the state. Data is incomplete; he used geospatial data and eradication numbers. Trends in eradication are up; partly because of increasing expenditures and better technology. It’s estimated that licensed production is 1.4 million pounds; illicit is about 11.4 but there’s a wide confidence interval (7.0 – 16.3). In 2020, 33% of CA consumption came from the licensed market; up to 38% in 2024.

Prices fell substantially in 2021/22, MacKuen told the committee. Since 2022, prices have stabilized or fell 3% over year; quarterly wholesale prices have raised a bit (4.8% in Q4 2024). Illicit prices and the double-digit tax rate are affecting prices in licit market. Unit prices at retail are lower, that’s what’s driving the decrease in the gross value of the industry. Some shift from flower into value-added product like edibles and pre-rolls. Market exits and consolidation are happening as the industry matures.

Committee Members’ Comments and Questions

Sen. Roger Niello (R-Rancho Cordova) expressed concerns about not enough focus on the demand side. He said he visited a health clinic recently, and nurse there spoke about their experience showing effects of chronic marijuana use. He read from a New York Times article from October – “As MJ legalization has accelerated across the country, doctors are dealing with an explosion of use and its intensity….with more people consuming more potent cannabis more often….serious health consequences.” He brought up CHS and psychosis, and lamented limited public health messages, and federal restraints on research have left consumers in the dark about such outcomes. [Nothing was said about the recent implementation of SB 540 which requires dispensaries and delivery services to make available a new brochure on health consequences.]

Sen. Smallwood-Cuevas (D-LA) asked for clarification on the impact of the illicit market on prices. Also, is enforcement happening in cooperation with other states? She said she noticed a lot of uncertainly around federal protection and engagement in the report. MacKuen responded that the illicit market does put downward pressure on price in the legal market. Dempsey responded some of the federal agencies like HIDTA work across state lines, and there is an AG’s alliance cooperate on prosecution and enforcement across state lines.

Smallwood-Cuevas then asked, “What is our employment looking like? What is the scale and size of workforce in this industry?” She said she was also curious how many people who have had previous drug convictions are they employed in this industry. MacKuen responded that he didn’t have employment numbers but he could come up with those with that via models. Dempsey responded that there are programs primarily at local level, and worker training programs supported by state employment development office to try to create entry into the market. Not everyone wants to be a business owner, some just want to work in the industry.

Asked by Smallwood-Cuevas for the percentage of workers who drug war survivors, Dempsey said the department doesn’t collect data on workers, but does regarding license holders. About 2100 businesses within CA that qualify as equity under states or local criteria, representing about a quarter of the licenses in the state. Equity is a broad umbrella. Extending provisional licensing, fee waivers and tax credits have created more avialable capital. Also, dedicated funding via GoBiz facilitates through Community Reinvestment Program funds programs and infrastructure invested into communities impacted by the WOD due to overpolicing.

Smallwood-Cuevas then drilled down on the “significant delays” in funding for transitioning from provisional to full licensing. LA county took 160 days to respond to requests. In Adelanto it was 540 days. What is driving delays and how can the department expedite? she asked, saying delays impact license holders who are doing their best to make a vibrant and robust industry. Kellum responded that that program expires at the end of the year, saying, “We hope to achieve our intended goal by that time,” admitting, there were bumps in road early on.

Asm. Jacqui Irwin (D-Ventura) opened saying, “One of big promises of legal market was that consumers could trust that products were safe.” She asked about the recent LA Times articles about product safety. Kellum replied there that has been a lot of “suggestive reporting” re: legal vs. illicit market. The illicit market has illegal pesticides, mold, dangerous operations, human trafficking etc. Looking at the legal market, the dept. has have expanded pesticide list beyond the current 66; will be reflected in coming regulatory changes to expand pesticide list. Also looking how to do laboratory work better. For other products, lab testing is predicated on framework from federal labs, but not for cannabis.

Irwin then asked about how the Dept. is making sure “we’re not seeing products aimed at children.” Kellum replied that the Dept. has increased compliance actions on that. Went from 20 actions in 2022 to 293 last year, already 120 this year. We expect judicial decisions will inform. Activities happening near schools, a couple weeks ago in LA.

Sen. Archelata (D-LA/OC) asked if cannabis was funding law enforcement and youth programs. He didn’t get a response. [But of course it does.]

Noting the drop in the number of licenses, Asm. Pellerin (D-Santa Cruz) said to MacKuen, “You presented consolidation as a good thing, and I’m concerned about small businesses.” MacKuen replied that it was not necessarily good, but expected. It’s a good thing for the consumer, because of lower prices produced by more efficient businesses. [Imagine this being said about the CA wine industry.] Pellerin asked what can we do to help small equity farmers, mentioning that she sponsored a bill last year to allow small farmers to sell cannabis at farmers markets that was vetoed by the Governor. Kellum replied that there is no “silver bullet” but that enhancing enforcement against the illicit market, making legal cannabis more broadly available, and addressing other intoxicating cannabinoids could help.

Quirk-Silva then came back to enforcement, saying she’s been told that we don’t have enough enforcement agents, and can’t recruit for dangerous jobs on salaries offered. Kellum said we should start wth 2.4 million illicit pounds being consumed in state. Enforcement is coming from licensing fees, as those are increased, it makes the cost of licensing more difficult. [The report suggested using cannabis tax monies for enforcement.] Kellum noted that 42% of jurisdictions don’t have legal retailers, but 60% of people there think they can purchase it legally. There’s a lot to do on consumer education and access.

Asm. Gipson noted that on Sept. 22, 2020 in LA, a 21-year-old El Camino student was working in cannabis shop and he wound up missing for a month; his body was found in a shallow grave in the desert. Illegal shops are getting shut down and re-opening again immediately. He brought up re-legalizing alcohol and suggested we take a page from that book. Kellum responded that, not diminishing the terrible harms caused by the illicit market, “I don’t think it’s enforcement activity alone that’s going to get us out of this competition. It’s having a strong legal market that consumers can trust.” Lack of retail access, high taxes and fees are problems for the legal market, he said. Regarding ending alcohol prohibition, he said, “If we wanted to disrupt another 100-year-old industry we wouldn’t want to make it more costly and less available.” Gipson asked for reports to the legislature from upcoming coordinating meetings with the Dept. and enforcing agencies.

Asm. Rebecca Bauer-Kahan (D-San Ramon) drilled down on how coordination of enforcement is happening with local officials, noting that at the state level there are 87 people enforcing, which is 1 1/2 people per county. She said when she got to the legislature, she learned about Weedmaps where you could see where illegal sellers were. Why not enforcement overnight? Is it true that if a DA brings a case they don’t get fine money to help with future enforcement. Dempsey replied that in cannabis, finding out who’s in charge of the operation is much harder, so the reinbursement piece is harder. Pressed about if DAs receive reimbursement once the owners are found, she was told the Dept. would get back to her on that.

Asm. Jessica Caloza (D-East LA) also talked about enforcement and her willingness to work towards a solution; she is concerned about closures of dispensaries in her district and what that’s doing to the economy and workforce. She asked about a federal forecast and was told that is “very unclear at this point.”

Public Commenters Call for Tax Relief

Almost everyone on committee left before public comment, during which almost all called for a cannabis tax reduction.

Amy Jenkins of CA Cannabis Operators Assn., representing 200 storefronts in 90 jurisdictions; also CannaCraft and Marsh & Ash. Jenkins said she found the report “overly optomistic” – excise tax revenue has dropped by $88 million since 2021, and there’s almost a $1.1 billion decline in market value. “You know something’s wrong when Michigan, a state with 1/4 of our population, is the top state in cannabis revenues,” she said. “If the market were truly growing, tax revenue wouldn’t be falling,” she noted, adding, “And now, amid the decline, we’re looking at a potential tax increase.” She called for, “a minimum,” freezing at it at 15%. She also called for expanding retail access; 42% of localities is “not right.”

Pam Lopez spoke for Cal NORML, California’s consumer rights and safety advocacy organization. “We have a singular priority this year,” she said. “We’re going to go over a cliff here” if the legislature does not act to stop the excise tax increase from 15-19% on July 1. “We know for sure if excise taxes increase that will dramatically affect the industry.” Cal NORML is sponsoring a bill, AB 564, to halt the tax increase, and she said she looked forward to working with committee members on the bill.

Jerred Killoh of the United Cannabis Retailers Assn. noted that there is $12 billion in demand for cannabis in the state, and the legal marked is only capturing $4 billion. Before Prop. 64 we had 2000 shops, now only 900. We’re lost over 200 retailers in LA in the last 18 months; 83% are in arrears on local taxes. Yet, there was no talk about tax reduction in the report or at the hearing.

Dan Simmons from CCIA said he echoed remarks made by Jenkins and Lopez. “We must be on a path for lowering, not raising excise tax,” mentioning about 60% of cannabis sold in the state is from the “untested, unregulated, and untaxed market.”

Alicia Priego from KIVA, manufacturing business in Alameda and LA, said she represents one of few remaining manufacturing businesses in the state. Over the past two years, KIVA has had to make significant employee reductions due to state of industry, she said, adding she is hoping to work this year to allow “this homegrown company to remain in the state.” Demand exists, we must take action, including reducing tax.

Diana Gamzon of the Nevada County Cannabis Alliance spoke next, representing small cannabis farmers and businesses. Just this week she heard from eight of their farmers giving up or pausing their licenses. Concerned about increase in excise tax. Licensing fees are extremely high, set when wholesale prices were 6x more. Trouble accessing fire insurance do to lack of inclusion in state-mandated insurance.

Sam Rodriguez from GoodFarmers Great Neighbors, representing outdoor and indoor farmers in Santa Barbara County, said, “The operative word today is uncertainty.” When only 40% of the market is being recouped, we are looking for tax relief and programmatic reform, he added.

Terry McHale, representing Cheech and Chong, spoke of a bill they are sponsoring bill by Asm. Flora dealing only with low-dose THC, demographically favored by women in 40s, age gated. We can raise $250 million, easily enforceable, he said.

Committee Chair Marc Berman (D-Palo Alto) wrapped up saying “the anxiety in the industry is real,” and that he “just heard of a bunch of bills already being sponsored by folks,” adding that he looks forward to more conversations to come.

What’s Next?

The Budget Subcommittee 5 hearing on cannabis is scheduled for (no fooling) April 1.