UPDATE 4:52 PM – Just got word the vote was 15-0-3.

At a hearing today in Sacramento, the California Assembly Business and Professions Committee passed through AB 564 (Haney), to halt a cannabis excise tax increase from 15% to 19% scheduled for July 1. Both committee chair Marc Berman (D-Palo Alto) and co-chair Heath Flora (R-Ripon) voted in support, as did all committee members present with the exception of Asm. Jasmeet Bains (D-Bakersfield), who abstained. The final vote count will be posted at the state’s legislative site later today or tomorrow.

Three hours into the hearing, Asm. Matt Haney (D-SF) introduced the bill, along with supporting witnesses Caryn Woodson of the California Cannabis Industry Assn. and Kristin Heidelbach of United Food and Commercial Workers. Pointing out that the bill would not decrease cannabis taxes, only keep them at their current level, Heidelbach ended her remarks by saying, “It is possible to tax an industry to death. Instead of punishing the legal operators and consumers with higher taxes, we should take steps to collect the taxes that have been stolen by the underground market and the intoxicating hemp market.”

Dozens of others stood up to express their support, including Cal NORML director Dale Gieringer, Richard Miller of American for Safe Access and the American Alliance for Medical Cannabis, and representatives from co-sponsors Origins Council, UCBA, and CaCOA. Many businesses were represented, among them Khemia, Kiva Confections, Proof Wellness, A Therapeutic Alternative, Cannacraft, Embarc, Jade Nectar, social equity business Natural High, The Highlands in Livermore, and WeHo’s Door Number Six cannabis lounge. Farmer advocates Good Farmers Great Neighbors and Nevada County Cannabis Alliance added their support, along with the Cannabis Distribution Assn., the Humboldt County Board of Supervisors, SEIU and Childcare Providers United. Luke Scarmazzo, who served nearly 15 years in Federal prison for operating a cannabis dispensary in Modesto, CA and now works with the social justice cannabis company Prophet Brands, expressed his support “on behalf of every man and woman who has been incarcerated for cannabis.”

The bill faced (and continues to face) strong opposition from a coalition of groups that receives “Tier 3” funding for youth programs from cannabis taxes, and has vociferously opposed any cannabis tax reform in California. The groups also objected during the hearing to a provision that would freeze cannabis excise taxes in AB 8 from Asm. Aguiar-Curry, which would further regulate hemp products in California.

Asm. Haney said in closing at the hearing that he is committed to childcare funding, and that language to amend AB 564 has been circulated to try to address some of those concerns. He noted that a 25% tax increase won’t lead to more funding, but rather would lessen proceeds as overtaxed cannabis businesses fail to compete against their unlicensed and untaxed competitors.

Before the vote was called, Chair Berman said, “As the state struggles with budget challenges and the Trump administration slashes funding for critical programs, I hear the voices of those concerned about the further loss of revenue to those programs, and I’m sure I speak for myself and my colleagues when I say that we’re committed to making sure that that our communities have the resources that they need, while doing what’s necessary to ensure that a cannabis industry still exists to tax in the first place.”

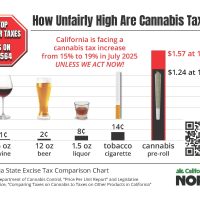

Cal NORML, an early sponsor the bill, launched a campaign pointing out the unfairness of cannabis taxation on behalf of California’s cannabis consumers. We brought citizen lobbyists across the state to Sacramento for a Lobby Day focused on the bill in March, where Asm. Haney spoke at a rally and press conference about the bill. Our Action Alert has generated nearly 1,250 letters from constituents to their Assemblymembers in favor of the bill, many of them to key legislators who sit on the B&P committee.

The bill goes next the Assembly Revenue and Taxation committee, where it is expected to see some opposition from committee members, considering how tight California’s budget is again this year. Cal NORML encourages all to continue to contact their Assemblymembers, particularly constituents of committee members.