MMJ Advocates Call on Cal. Board of Equalization for Representation with Taxation

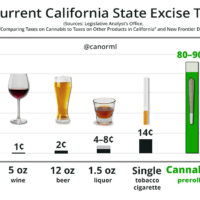

SACRAMENTO, March 18th, 2008. Medical marijuana advocates appealed to the state Board of Equalization to recognize their contribution to California’s sales taxes revenues and stand up for their right to “taxation with representation.” The Board heard testimony from California NORML, ASA, and half a dozen dispensary owners concerned about harassment by DEA despite paying sales taxes to the BOE.

Speaking for ASA, Rebecca Saltzman reminded the Board that California’s dispensaries are generating some $100 million in sales tax revenues, but are nonetheless being threatened with raids, arrest and asset seizure by the DEA. She asked the Board to stand up for the dispensaries and urge the Governor to do likewise.

Cal NORML coordinator Dale Gieringer testified that the total retail market for medical cannabis is around $870 million to $2 billion per year in California, enough to generate $70 to $160 million in sales taxes, according to a report by Oakland’s Measure Z marijuana oversight committee. He noted that DEA raids have robbed the state of millions in dollars of sales tax revenues, and that the DEA had even gone so far as to confiscate sales tax payment checks in the process of their transfer to the BOE.

Lisa Sawoya, director of Hollywood Compassionate Care in LA, testified that she had begun paying sales taxes in 2006 and had voluntarily sent the board six months’ back taxes, but was nonetheless subsequently raided and shut down by the DEA.

Dona Frank of Organic Cannabis Foundation in Sonoma Co. testified that her group had paid $500 K in sales taxes in 2007, and would continue to do so, but had nonetheless been forced to move on account of DEA landlord letters. She called on the board to “stand up” against the DEA’s actions.

Lisa Molyneux of Greenway Compassionate Relief in Santa Cruz said she was providing workers with employment, benefits and health insurance, in addition to paying taxes, but that DEA raids were putting these revenues at risks.

Rebeccca De Keuster of Berkeley Patients’ Group said that dispensaries were caught in a “Catch-22” situation. She testified that the DEA had seized $100K that BPG had saved up to pay taxes, and that their raids appeared to be timed to the last week of the month, just before bills are paid.

Bill Pearce, director of the River City Patients’ Dispensary in Sacramento, testified that he had paid $700K in sales taxes to the BOE plus $250K more to the IRS and Franchise Tax Board, before being shut down and having assets seized by the DEA.

Tariq Alazraie, manager of Purple Heart Caregivers and the former Mason St dispensary in S.F., said the board had an obligation to stand up for dispensaries, given that it was recognizing them by accepting their tax payments.

State BOE member Betty Yee urged her colleagues to heed advocates’ testimony, saying she felt a “tremendous sense of responsibility on this issue,” and it would “not be a pretty picture” if dispensaries were driven back underground. BOE member Bill Leonard, one of the Board’s Republicans, said he was concerned about allegations that the board might have shared confidential information with federal investigators, declaring that confidentiality laws strictly forbid any such cooperation except by subpoena.

Medical cannabis activists left the hearings with the impression that the Board had given them serious attention, and hopeful that their objections to ” taxation without representation” will be heard by other public officials, including the Governor.