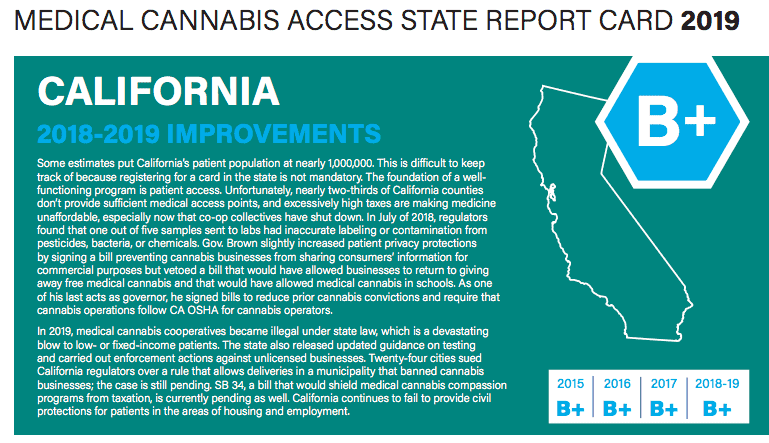

In the yearly Medical Cannabis Access Report Card from Americans for Safe Access, California still has only a B+ Grade.

The report states:

In 2019, medical cannabis cooperatives became illegal under state law, which is a devastating blow to low- or fixed-income patients. The state also released updated guidance on testing and carried out enforcement actions against unlicensed businesses. Twenty-four cities sued California regulators over a rule that allows deliveries in a municipality that banned cannabis businesses; the case is still pending. SB 34, a bill that would shield medical cannabis compassion programs from taxation, is currently pending as well. California continues to fail to provide civil protections for patients in the areas of housing and employment.

Cal NORML has made employment rights for cannabis consumers a legislative priority. For the past year, we have been surveying California cannabis users about discrimination due to employment or physician drug testing, and also have an active survey on delivery services. We are lobbying and activating our members in favor of SB 34.

SB420, the law Cal NORML fought for that protected nonprofit cannabis collectives, sunsetted in January; now collectives growing for more than five patients must have state licensing. We are gathering data for the Prop. 64-mandated report on nonprofit collectives that is due on 1/1/2020. Anyone with input into that report, please write here.

The report is mandated by California Business and Professions Code 26070.5, which states:

(a) The bureau shall, by January 1, 2020, investigate the feasibility of creating one or more classifications of nonprofit licenses under this section. The feasibility determination shall be made in consultation with the relevant licensing agencies and representatives of local jurisdictions which issue temporary licenses pursuant to subdivision (b). The bureau shall consider factors including, but not limited to, the following:

(1) Should nonprofit licensees be exempted from any or all state taxes, licensing fees and regulatory provisions applicable to other licenses in this division?

(2) Should funding incentives be created to encourage others licensed under this division to provide professional services at reduced or no cost to nonprofit licensees?

(3) Should nonprofit licenses be limited to, or prioritize those, entities previously operating on a not-for-profit basis primarily providing whole-plant cannabis and cannabis products and a diversity of cannabis strains and seed stock to low-income persons?