“Joint” Hearing Held on Condition of California Cannabis Industry

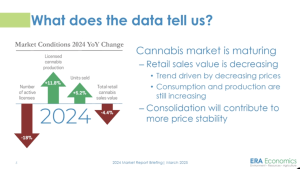

A “Joint” informational hearing on March 11 before the Assembly and Senate Business and Professions committees on the CA Department of Cannabis Control’s new Condition and Health of the Cannabis Industry Report presented a grim picture of the state of the industry and its future. Asm. Mike Gipson (D-LA), chair of the Assembly Revenue & Tax committee, and Asm. Sharon Quirk-Silva (D-Buena Park) who chairs the Budget subcommittee that oversees the Department of Cannabis Control (DCC), also participated. Quirk-Silva said the findings in the DCC report are “very concerning.” Active licenses and total retail sales value are both down. “Is