At Gov. Newsom’s press conference this morning announcing his May budget revision, he was asked about his proposal to end the cannabis cultivation tax while keeping the state excise tax at 15%, while granting authority to raise the tax to as much as 19% if tax revenues fall below $670 million as soon as January 2024.

At Gov. Newsom’s press conference this morning announcing his May budget revision, he was asked about his proposal to end the cannabis cultivation tax while keeping the state excise tax at 15%, while granting authority to raise the tax to as much as 19% if tax revenues fall below $670 million as soon as January 2024.

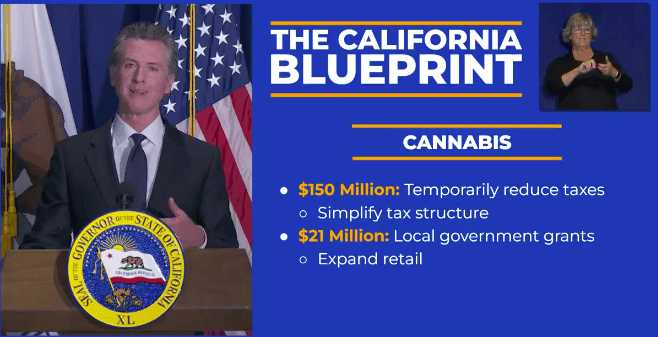

Newsom announced a $150 million “backfill” from the General Fund to cover any temporary tax income reductions that may affect youth, environmental, or law enforcement programs that are currently funded with Prop. 64 taxes, while announcing a $20.5 million grant program for local governments looking to open cannabis retailers, with additional funding to local jurisdictions that permit to equity applicants.

Newsom thanked the people leading this effort, including Sen. Bradford, who just picked up an award at the Cal NORML / ASA Lobby Day for his work toward equity and fairness for cannabis in California. Bradford’s bill SB 1281 was the only legislative proposal this year to end the cultivation tax without raising excise taxes. Cal NORML testified in favor of Bradford’s bill in the Senate Governance and Finance committee and lobbied on tax reform and Bradford’s bills SB 1281 and SB 1293, to grant $10K yearly income tax credits to equity businesses at Lobby Day last week.

TELL YOUR LEGISLATORS TO SUPPORT CANNABIS TAX REFORM IN CALIFORNIA.

The Governor cited local governments’ lack of support by not allowing retail, distribution, and other cannabis businesses, in announcing his proposed grant program for locals. “This will be a multiyear process to get go after the illegal market and put the adult use market on steady ground,” he said.

Overall, the budget spends $300.7 billion and a $97.5 billion surplus, with $49.2 billion of that amount discretionary to be spent by lawmakers because it’s not earmarked for specific programs.

In 2021, the excise tax from cannabis in California brought in $668 million, and the cultivation tax amounted to $163 million. Sales taxes on cannabis products brought in $463 million for a total tax revenue of $1.3 billion on $5.2 billion in sales. The state is expecting to distribute $401.8 million for education, youth substance misuse treatment and school retention; $133.9 million for environmental clean-up and remediation related to illicit cannabis manufacturing and $133.9 million for law enforcement purposes.

State lawmakers now have until June 15 to send a budget plan to Newsom’s desk for the fiscal year that begins July 1.

Read the budget proposal.

In excerpt:

CANNABIS CANNABIS TAX REFORM

California’s current cannabis tax framework is overly complex and burdensome for licensees and consumers. Current tax policies disproportionately burden cannabis farmers, create additional administrative costs and instability throughout the supply chain, and lack sufficient transparency for the state, businesses, and consumers. Taken together, these outcomes undermine the societal benefits of a taxed and regulated market. The May Revision proposes statutory changes to reform cannabis taxes. These policy changes aim to greatly simplify the tax structure, remove unnecessary administrative burdens and costs, temporarily reduce the tax rate to support shifting consumers to the legal market, and stabilize the cannabis market with policies that are more transparent and can better adjust to market changes.

Major changes include:

• Setting the cultivation tax rate at zero beginning July 1, 2022.

• Shifting the point of collection and remittance for excise tax from distribution to retail on January 1, 2023, maintaining a 15 percent excise tax rate.

• Setting Allocation 3 funding for youth education/intervention/treatment, environmental restoration, and state and local law enforcement programs at a baseline of $670 million annually for three years. Up to $150 million one-time General Fund is available as needed through 2025-26 to backfill Allocation 3 funding, along with the authority to increase the excise tax rate through 2024-25 if tax revenues fall below the baseline for Allocation 3.

• Strengthening tax enforcement policies to increase tax compliance and collection and reduce unfair competition.

CANNABIS LOCAL JURISDICTION RETAIL ACCESS GRANT PROGRAM

To assist the cities and counties of California that do not currently license storefront or delivery-only cannabis retailers, the May Revision includes $20.5 million one-time General Fund to establish a cannabis local jurisdiction retail access grant program. The goal of this grant program is to aid localities with the development and implementation of local retail licensing programs and to support consumers in gaining access to regulated and tested products through an expansion of California’s legal marketplace. This grant program will:

• Award funding to eligible local jurisdictions proportionally based on the population size served to support the development and implementation of a local jurisdiction retail program.

• Award funding to eligible local jurisdictions based on the number of permits issued pursuant to the local jurisdiction retail licensing program.

• Award additional funding to eligible local jurisdictions that issue permits to equity applicants pursuant to the local jurisdiction retail licensing program.

Also see: Newsom Pledges to Work for Cannabis Tax Reform in State Budget Proposal