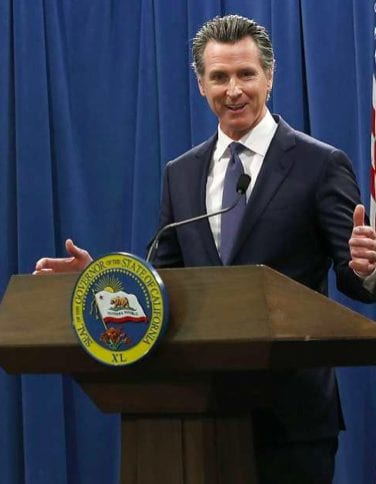

Governor Gavin Newsom has issued a revised state budget with several cannabis provisions, according to the budget summary.

Governor Gavin Newsom has issued a revised state budget with several cannabis provisions, according to the budget summary.The revised budget forecasts the state cannabis excise tax will generate $288 million in 2018-19 and $359 million in 2019-20, a reduction of $67 million and $156 million, respectively, from the original Governor’s Budget forecast. It states, “The forecast assumes continued growth of more than 15 percent annually as new businesses continue to enter the marketplace and local jurisdictions adjust to the state’s legal framework. It is important to note that for the near term, revenue estimates will be subject to significant uncertainty because the market has only recently been established.”

The May Revision for the first time earmarks funds, to the tune of $26 million, to pay for public health and safety program grants in local jurisdictions that don’t ban cannabis retail or cultivation (including personal outdoor cultivation). It also includes $15 million from the Cannabis Tax Fund to provide grants to local governments to assist in the creation and administration of equity programs.

The budget document was released along with statutory language in a trailer bill addressing clean-up issues related to the California Cannabis Appeals Panel statute, streamline provisional licenses, enhance the equity grant program, strengthen administrative penalties for unlicensed cannabis activity, and extend the existing CEQA exemption.

The budget bill must be passed by 6/15 and signed by the end of June. Trailer bills are not required to be passed by that deadline. The Legislature can make amendments to the bill before presenting it for the Governor’s signature.

With the caveat that the dollar amounts are subject to change and will be affected by actual cannabis tax receipts for the final two quarters of 2018-19, the May Revision estimates $198.8 million will be available for the Cannabis Tax Fund, and allocates them for the first time in 2019-20 as identified below:

Education, prevention, and treatment of youth substance use disorders and school retention—60 percent ($119.3 million):

- $12 million to the Department of Public Health for cannabis surveillance and education activities.

- Remaining 75 percent ($80.5 million) to the Department of Education to subsidize child care for school-aged children of income-eligible families to keep these children occupied and engaged in a safe environment, thus discouraging potential use of cannabis.

- Remaining 20 percent ($21.5 million) to the Department of Health Care Services for competitive grants to develop and implement new youth programs in the areas of education, prevention and treatment of substance use disorders along with preventing harm from substance use.

- Remaining 5 percent ($5.3 million) to California Natural Resources Agency to support youth community access grants. These grants will fund programs to support youth access to natural or cultural resources, with a focus on low-income and disadvantaged communities. This includes but is not limited to community education and recreational amenities to support youth substance use prevention and early intervention efforts.

Clean-up, remediation, and enforcement of environmental impacts created by illegal cannabis cultivation—20 percent ($39.8 million):

- Sixty percent ($23.9 million) to the Department of Fish and Wildlife, of which $13.8 million will support clean-up, remediation, and restoration of damage in watersheds affected by illegal cannabis cultivation and $10.1 million to support enforcement activities aimed at preventing further environmental degradation of public lands.

- Forty percent ($15.9 million) to the Department of Parks and Recreation, of which $7.1 million will be used to survey the impacts and identify unknown areas of cannabis cultivation to assist with prioritizing resources for effective enforcement, $5.6 million for remediation and restoration of illegal cultivation activities on state park land, and $3.2 million to make roads and trails accessible for peace officer patrol and program assessment and development

Public safety-related activities—20 percent ($39.8 million):

- $2.6 million to the California Highway Patrol for training, research, and policy development related to impaired driving and for administrative support.

- Remaining 30 percent ($11.2 million) to the California Highway Patrol’s impaired driving and traffic safety grant program for non-profits and local governments authorized in Proposition 64.

- Remaining 70 percent ($26.0 million) to the Board of State and Community Corrections for a competitive grant program for local governments that have not banned cannabis cultivation or retail activities that will prioritize various public health and safety programs, including, but not limited to, local partnerships focused on prevention and intervention programs for youth and to support collaborative enforcement efforts aimed at combating illegal cannabis cultivation and sales. (These grants were provided for in Prop. 64, Section 34019(f)(3)(C) of the Revenue & Taxation Code.)

• Allows licensing authorities to access administrative fines of $5 per violation and $30,000 fines per violation for unlicensed operators; each day constitutes a separate violation. Licensing authorities are to take into account the gravity of the violation, the good faith of the licensee or person, and the history of previous violations. Fines must be paid within 30 days; those fined may request a hearing within 30 days of issuance of a citation.

Monies collected will be deposited into the Cannabis Control Fund pursuant to subdivision (d) of Section 26210. Language is added to that section to make Cannabis Control Funds available “for the purposes of aiding individuals’ access to licensure” upon appropriation by the Legislature.

• Extends equity programs to those jurisdictions that demonstrate “an intent to develop a local program,” as well as those who have adopted such program (Section 26240 (e)). It defines “equity assessments” required to be made by local jurisdictions, including local historical rates or arrests or convictions for cannabis law violations and their impacts to local communities.

Section 26244 allows jurisdictions to apply to the BCC for a grant to assist with the development of an equity program. “Assist” is defined to include providing low-interest or no-interest loans to local equity applicants or licensees that can be used to pay rent, licensing fees, legal assistance, testing of cannabis, workforce training, fixtures and furniture. Allows the Bureau to enter into an interagency agreement with the Governor’s Office of Business & Economic Development to administer equity program grants, and also allows the Governor’s B&ED department to administer grants on their own.

UPDATE: The California Legislative Analyst office released a report on May 24 estimating that 2018/19 cannabis tax revenue will be $307 million—$19 million above the administration’s May Revision estimate. The figure is based on third-quarter 2018/2019 (Jan-Mar 2019) revenues released by the CDTFA showing that California’s cannabis excise tax generated $61.4 million and the cultivation tax generated $16.8 million, with an additional sales tax of $38.4 million, for a total of $116.6 million.