UPDATE 5/8/2025 – Please take action on our new alert targeted at the full legislature and the Governor, asking them not to increase cannabis taxes in 2025.

California is set to increase its excise tax on cannabis from 15% to as much as 19% starting on July 1, 2025, as part of a budget compromise made when the cannabis cultivation tax was removed via AB 195 (2022), in order to assure adequate funding for programs funded by cannabis taxes.

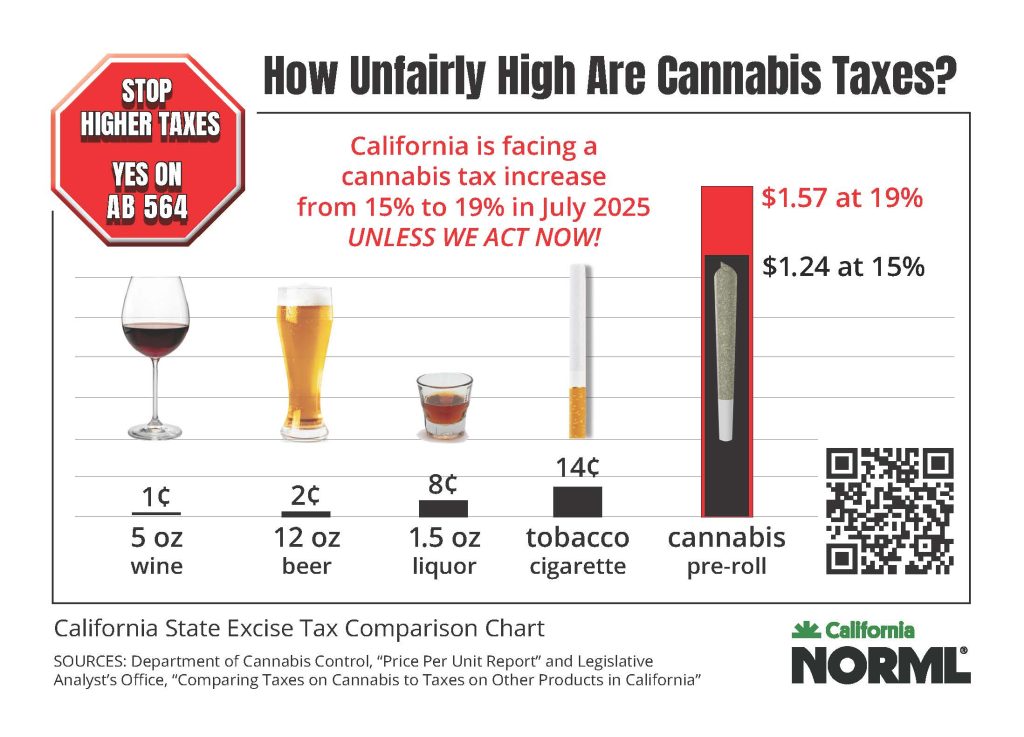

A bill sponsored by Cal NORML, AB 564 (Haney) has been introduced to block this pending excise tax increase.

Cannabis is already heavily over-taxed relative to comparable products like beer, wine, and tobacco in California.

The excise tax on one average, noninfused cannabis pre-roll is $1.24. In contrast, the excise tax on one glass of wine is $.01; a glass of beer $.02, a shot of liquor $.05-.08, and a tobacco cigarette $0.14. Adding in state sales tax and local taxes, cannabis products are taxed at a rate as as high as 38% (44% if delivered), and since taxes are compounded at the retail level, increasing the excise tax to 19% will increase the total tax to as much as 48%, roughly adding another $5 in taxes onto a $100 purchase, on top of the $38–$44 consumers are already being charged.

Cannabis taxes currently contribute more to California’s coffers than do alcohol taxes, despite far less sales. Gov. Newsom’s 2023/24 budget estimated an income of $440 million from alcohol taxes. By contrast, state excise taxes on cannabis brought in $624 million in 2023.

Any tax increase would negatively impact cannabis consumers and businesses in California.

The industry needs a tax decrease, not an increase. The industry is struggling to compete against overtaxation, the illicit market, resistance to local licensing, and the proliferation of hemp-derived products. Medical marijuana patients in particular are unable to meet their needs for cannabis products under current pricing.

A new report from the CA Department of Cannabis Control estimates that total California cannabis consumption is 3.8 million pounds, and that only 1.4 million pounds is sold from the licensed market, with 2.4 million pounds coming from the unlicensed and untaxed market. Also see: California’s New Marijuana Database Shows The Legal Market Is Smaller And Weaker Than We Thought

Inactive cannabis licenses are climbing as California companies struggle to stay in business. There are currently 7,100 inactive cultivation licenses, over 1,100 inactive distribution licenses, nearly 500 inactive delivery licenses and over 300 inactive retail licenses. Inactive licensees don’t make money, or pay taxes. Many of the inactive licenses are equity businesses, who are already facing a de facto tax increase this year as the cannabis equity tax credit is set to expire on 12/31/25.

According to the California Department of Cannabis Control, as of February 2025, 57% of California cities and counties do not allow any retail cannabis businesses, resulting in California having one of the lowest rates of retail stores per capita in the nation among states that support adult-use sales.

California is falling short of other states in per capita legal cannabis sales:

| State | Per Capita Cannabis Sales in 2023 |

| Michigan | $295.39 |

| Montana | $288.96 |

| New Mexico | $254.43 |

| Oregon | $221.67 |

| Missouri | $218.62 |

| California | $98.40 |

Source: https://www.cannabisbusinesstimes.com/news/state-cannabis-sales-trends-august-2023/

Michigan, with its 10% state excise tax that is shared with local jurisdictions (which have no taxes of their own), is pointed to as a model for a successful roll-out of marijuana legalization. Missouri has a 6% state excise tax and caps local taxes at 3% (California has no such cap). If California were on par in per capita sales with Michigan or Montana, it would be generating an estimated $13 billion in annual sales, and the state would be collecting substantially more tax revenue. Instead, the taxable sales for cannabis in 2024 was $4.6 billion. Also see: California dethroned as this state now sells more legal weed.

Support for Tax Reduction is Growing

California’s Attorney General Rob Bonta, who sponsored cannabis tax reduction legislation when he was in the Assembly, said when he announced his office’s CAPP Program to target illicit cannabis operations in August 2023: “The barriers to entry [to the licensed cannabis market] are too high. The costs to stay in operation are too high. We should be lowering taxes at least temporarily for our cannabis businesses, and we should make the regulatory burden less than it is while we target the illicit base that is undercutting them.”

A petition to the Governor asking or tax relief has begun, and over 100 signatures have been gathered on a letter to Gov. Newsom asking for medical marijuana patients to be exempted from taxation, something that has long been needed and was enacted in Washington state last year. A recent analysis from Whitney Economics found that in Washington state, whose taxes are comparable with California’s, legal market participation is only ~50%, largely due to excessive taxes, and argues that a reduction in the tax rate would substantially expand legal market participation (and tax revenue).

Recipients of Tier 3 cannabis tax funding for youth education and prevention programs have vociferously opposed any proposed tax reduction on cannabis. As of March 2024, Tier 3 programs had a surplus of $607 million ($260 in the law enforcement account, plus $357 million in the childcare account). Full accounting and evaluations of Tier 3 programs have been legislatively mandated, but have not been provided by the agencies receiving the funds.