DOWNLOAD A FLYER ABOUT CANNABIS TAX FAIRNESS IN CALIFORNIA

UPDATE 7/10/2023 – SB 512 (Bradford), to end double taxation on cannabis by including state and local excise taxes when calculating other taxes, was held in the Assembly Revenue and Taxation committee and will likely not advance this year in its present form.

Committee chair Jacqui Irwin, who authored a bill to make cannabis billboards illegal in 2012 and whose current bill AB 1207 to restrict cannabis packaging and flavorings was opposed by cannabis industry groups, commented at the hearing that it’s too soon to evaluate the results of AB 195 (2022), which eliminated the cannabis cultivation tax and shifted the responsibility for paying state excise tax from the distributor to the retailer, while making the changes SB 512 sought to correct.

Cal NORML supporters have sent in nearly 900 letters in support of the bill and our director Dale Gieringer spoke up in its favor at the hearing. We will continue to advocate for cannabis tax reform in California. Stay tuned.

Under the Adult Use of Marijuana Act, the cannabis excise tax is set at 15% of gross receipts from licensed retail cannabis sales. Many local governments impose additional taxes on cannabis, ranging as high as 10% in some jurisdictions, including Los Angeles.

Local governments are currently required to include these state and local excise taxes in the definition of “gross receipts” when charging additional sales taxes of 7.25 – 10.5%.

SB 512 would end this double or triple taxation on cannabis, delivering much-needed relief to what is currently an unfairly overtaxed industry.

Please tell your lawmakers to support cannabis tax reform and SB 512.

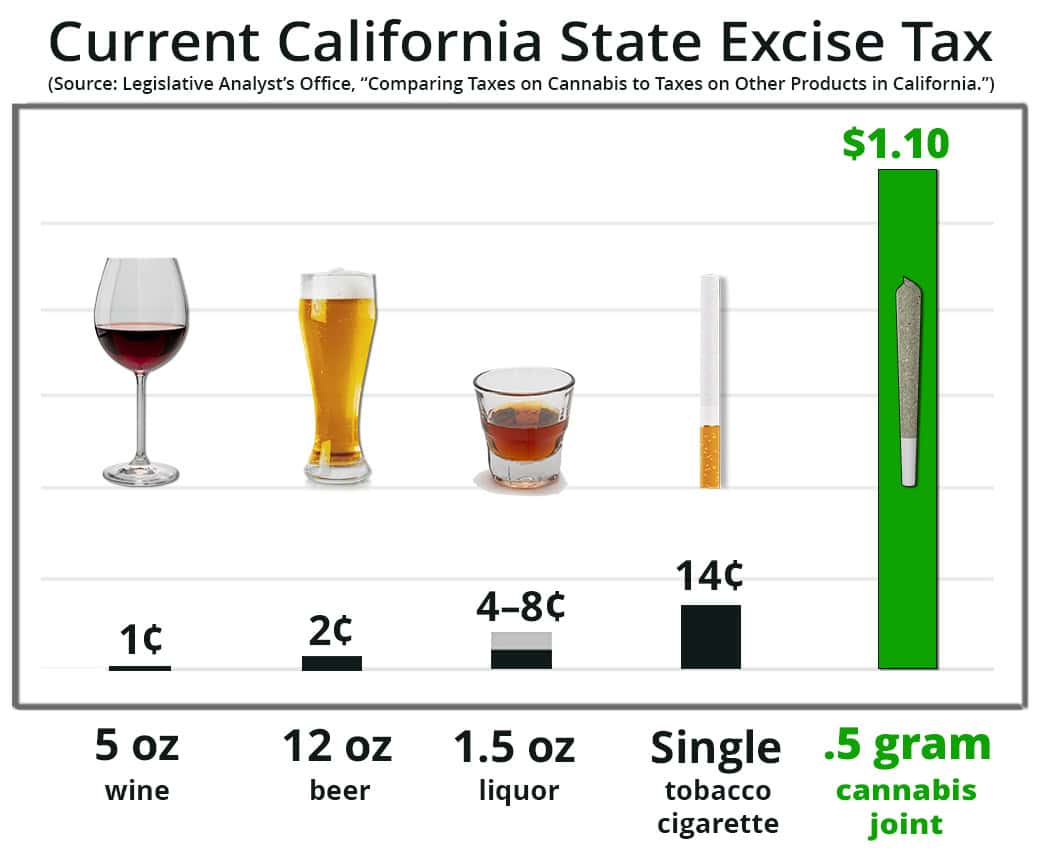

Cannabis is already heavily overtaxed relative to comparable goods in California. Adding the sales and use tax of 7.25% to 10.5% on top of the excise tax raises the cost of a joint by another 8 – 11 cents—more than the total state excise taxes for an alcoholic beverage. If local cannabis taxes are added in, the difference ranges as high as 18 cents.

Cannabis sales currently contribute more to California’s coffers than do alcohol taxes, despite far less sales. Overtaxation impedes legal, tested, and taxed cannabis access for consumers and fuels the illicit cannabis market. California’s cannabis consumers want access to safe, tested, and fairly taxed products.

Please tell your lawmakers to support SB 512.

BACKGROUND

The double taxation started not in Prop. 64 but when the 2022 budget bill AB 195 shifted the excise tax payment responsibility from the distributor to the retailer. The bill amended Section 34011(d) of the Revenue and Taxation Code to define gross receipts from the sale of cannabis or cannabis products for purposes of assessing the sales and use taxes to include the 15% excise tax. Subsequently, the CDFTA instructed retailers to add in delivery fees and local taxes to the definition of gross receipts for the purposes of accessing state excise taxes, making for triple taxation.

Compounding the issue of taxing the taxes, many jurisdictions have local cannabis tax laws that are now in direct conflict with the directive issued by the CDTFA. For example, the City of Los Angeles’s definition of their gross receipts tax (LA Municipal Code: Section 21.51 (a)4) is in direct conflict with the CDTFA’s guidance. This conflict leaves retailers in LA and elsewhere subject to fines or loss of licensure.

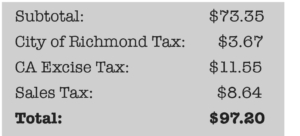

A $73.35 purchase made recently at a CA cannabis shop turned into the customer paying $97.20 at the register. SB 512 would have saved $2.03 off this sale by not re-taxing the excise taxes, a small step towards #cannabistaxfairness.

SB 512 would clarify and roll back the double and triple taxation on cannabis, which is helping to drive consumers back to the illicit market in California, in the end undercutting the tax base.